Redstone Oracles for Dummies: All You Need to Know in 2 Minutes

Over the past six months, Redstone has emerged as the third-largest EVM-based oracle provider and a leader in the Liquid Staking Token (LST) and Liquid Rebase Token (LRT) space

Understanding Oracles in DeFi

Oracles are essential in DeFi, serving as the backbone of all markets. They connect off-chain data to the blockchain, enabling price feeds and other crucial information to be available on-chain. Nearly all DeFi protocols depend on oracles to function.

Oracle Design Approaches

Oracles have two distinct designs today:

Push (Chainlink Approach): Continuously pushes data based on price deviation or, at set intervals, ensuring a constant stream of updated information.

Pull (Newer Approach): Price data is pulled only when needed, making it a cost-effective solution that delivers data only when necessary, reducing latency.

For innovative DeFi protocols, pull oracles are often the best choice due to their efficiency and reduced costs.

RedStone’s Unique Approach

RedStone specializes in the pull-based approach for DeFi. It offers a modular design that allows innovative DeFi protocols to access accurate price feeds.

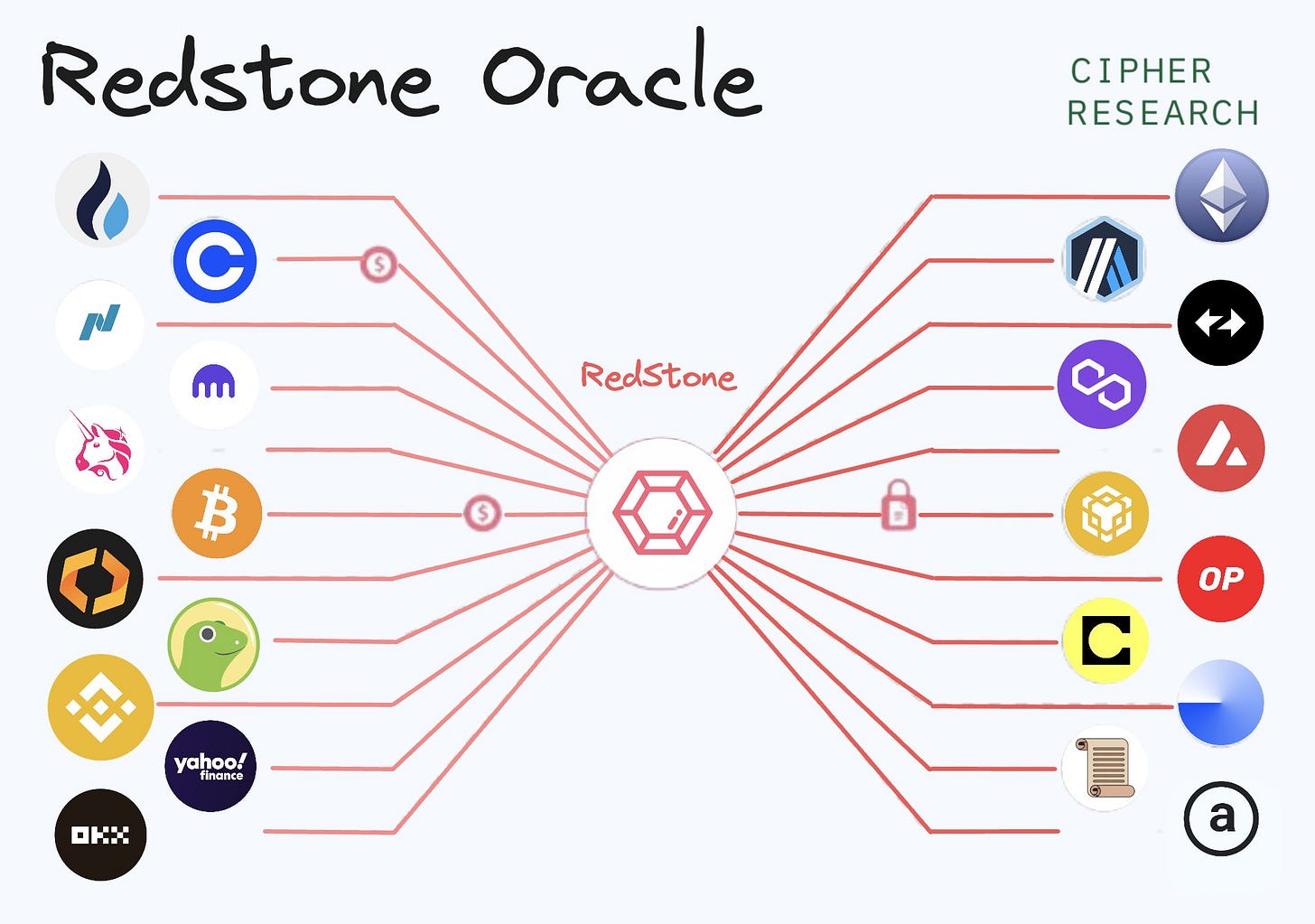

Supporting over 1,000 price feeds from 50 sources, including centralized exchanges (CEXs), decentralized exchanges (DEXs), other oracles, and market data aggregators, RedStone ensures a comprehensive and flexible data solution.

Redstone Integration Options

While RedStone specializes in the pull-based approach, it offers protocols three different integration options:

Core (Pull-Based Oracle): Provides low cost and maximum efficiency for protocols.

Classic (Push-Based Oracle): Follows the traditional Chainlink structure, ensuring constant data streams.

X (Frontrunning Protection): Designed for perpetuals and complex DeFi protocols, adding an extra layer of security against market manipulation.

This ensures maximum customization for DeFi protocols, catering to diverse needs and applications.

Redstone has had Phenomenal Growth

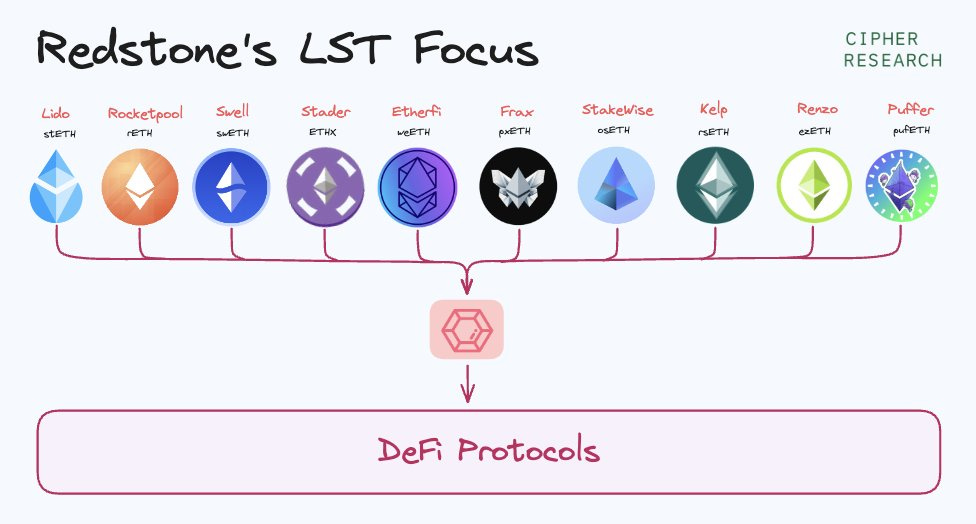

RedStone has recently experienced a tremendous increase in value secured. Leading DeFi protocols such as Swell Network, Pendle, Morpho, and Ethena Labs have integrated RedStone.

Over the past seven months, the Total Value Secured (TVS) has surged from $550 million to an impressive $3.7 billion.

The biggest driver of this growth has been RedStone's LST price integrations, positioning it as a leading oracle in the LSD boom by integrating most major LSD pricing.

RedStone and RAAS Ecosystem

RedStone is at the forefront of the Rollups as a Service (RAAS) ecosystem.

Its modular framework enables any EVM-compatible Layer 2 to quickly deploy and access low-latency data.

In contrast, large oracles like Chainlink require months for integration. RAAS providers, such as Gelato Network, offer native integrations with RedStone when creating a rollup, streamlining the process significantly.

RedStone provides the second-highest number of chain support in the entire space, second only to Pyth, thanks to its modular nature. Based on value secured, RedStone still has significant growth potential, especially considering it has not yet issued a token:

Chainlink: $41.5 billion

Pyth: $7.92 billion

RedStone: $3.833 billion

Redstone Tech in the Background

In the background, RedStone uses a unique method to obtain data from providers and deliver it to end consumers. Oracle nodes aggregate data using various methods and perform outlier detection.

The signed data is then delivered to the Decentralized Data Layer (DDL), broadcasted, and archived on Arweave to ensure the accountability of the data providers. Finally, the data is pushed on-chain.

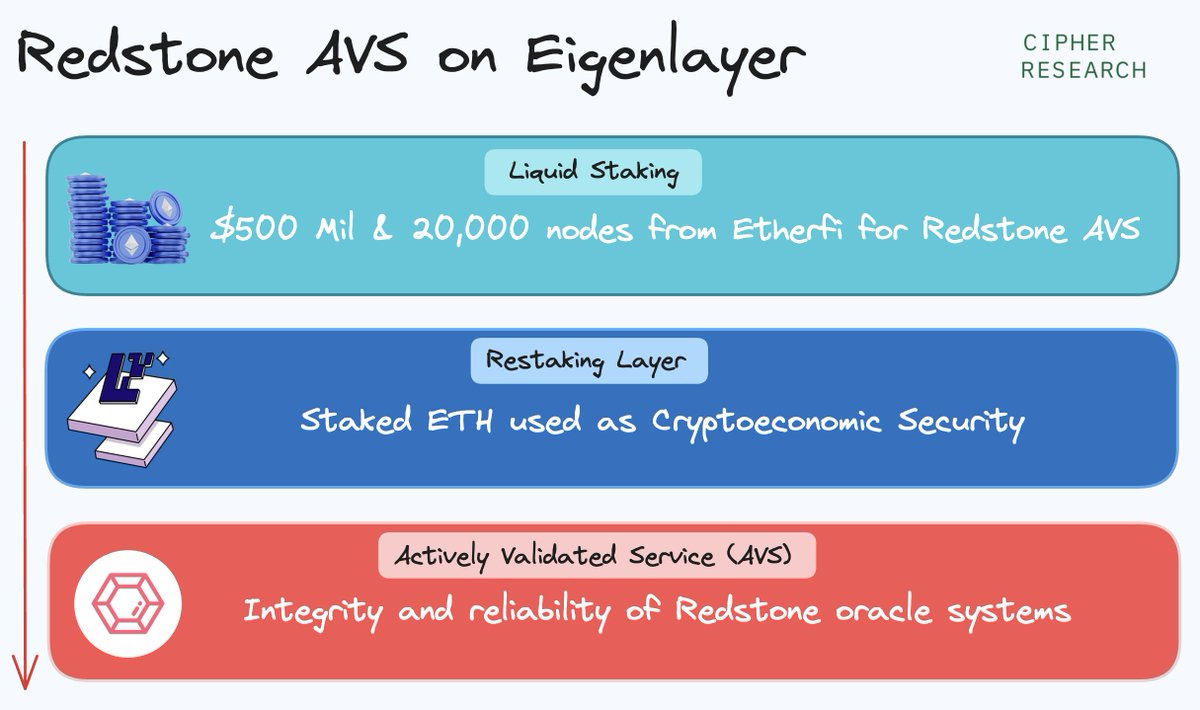

RedStone is also building an Actively Validated Service (AVS) on Eigenlayer. Ether.fi has committed $500 million to help secure RedStone's data, and a subset of 20,000 node operators will manage RedStone's AVS.

This initiative is set to make RedStone even more reliable.

Token Launch

In the coming months, RedStone is set to launch its token. Initially, the token will serve several purposes:

Data Access Fees: Users reward data providers.

Locking: Providers lock tokens to ensure reliability.

Dispute Resolution: Tokens used to settle data conflicts.

Bootstrapping: Early rewards for data providers.

Considering the significant achievements of RedStone without tokens and incentives, there is optimism about the traction it will receive post-launch. Pyth's impressive growth after its token launch last year is a clear indicator of potential success.

Conclusion

RedStone Oracle is running a large campaign leading up to the token launch, offering an excellent opportunity to get involved for future rewards.

With significant growth, innovative solutions, and more bullish catalysts on the horizon, RedStone’s future looks promising in the DeFi space.